In the My Future Project, you will make some decisions and figure some things out about a possible future education and career path as well as some basic finances. When you are choosing a career, try to find one you think fits you well.

Basic Career Information

The first thing you will do is decide on a job. Think about the results from your EDP. Check the Occupational Handbook to find the best career for you based on your EDP, and what you know about yourself. The 16 Personalities test may also offer some insight into future career possibilities.

Use these websites for career information

Employment Reference – Employment Outlook Handbook

Employment Reference – Top 100 Jobs (for ideas)

Once you have a career selected, complete the “Basic Career Information Table” in Google Classroom.

Cost of College

Your next job is to figure out some things regarding the training necessary for the career you want. This will require a bit of research and some calculations. Open up “Cost of College” in Google Classroom and answer questions 1-7. This will require some predictions about your total cost of going to college and how much money you will have to help cover costs. This includes how much financial help you may get as well as how much you intend to work or pay your own way.

Once you have basic college cost information, move onto the “Time for Payback” college cost simulation. Run the simulation twice. The first time, try to run it as accurate and close to your own real life as possible. The second time, try to run a scenario that is either exceptionally frugal, or exceptionally costly. Fill in the table accordingly. It’s easiest if you open two windows and work side by side with the Cost of College doc on one side, and the Time for Payback simulation on the other.

Post College Finances

There are some jobs that provide substantially more income than a typical bachelors degree. Pursuing these degrees in real life require and extra measure of effort. The same will be true in your My Future Project.

Becoming a professional with an advanced degree takes an extra level of commitment. If you want a career as a physician, lawyer, dentist, orthodontist, or any other “professional” degree, you need to fulfill the following extra requirements by January 20:

- provide proof of all A’s or almost all A’s in middle school so far

- be involved in at least one extracurricular activity

- provide 2 typed letters of recommendation – one from a non-family member, and one from a teacher (not Mr. Brumwell). The letters should complete the statement, “why I think (insert your name) would make a good (pick physician or lawyer)”. The letters should include information about your academic performance, ability to manage extracurricular activities and your character in general.

Gross Income is the entire amount of money you make.

Net Income is what you have left after you pay your obligatory taxes.

Once you’ve found your dream job, there’s an important detail to consider when you look at the amount of money you earn and begin to plan how to spend it. One of the disappointments of that first paycheck is learning that all the money you make is not yours to spend.

You live in a country, state and city that each provide services to you as a citizen. These services are paid with tax dollars. The tax dollars come from you as a wage earning citizen. You will pay income taxes to the federal government, state government and whatever type of municipality you live in (township, city, village, etc.) You will also be required to pay into medicare, social security. It’s possible for an employer to deduct additional money for things like union dues, insurance premiums, or additional retirement contributions.

The amount you get paid is called your gross income.

The amount you have left after taxes and deductions is your net income. A middle income person should expect to pay around 1/3 of your gross income in taxes. Net income is the money you get to spend.

For this project, you will calculate your federal income tax, state tax, social security and medicare. Each of these taxes helps pay for a benefit that you have as a U.S. citizen. Federal tax helps pay for our military. Read this article at National Priorities to get a more clear picture of what the U.S. Federal Government spends its money on.

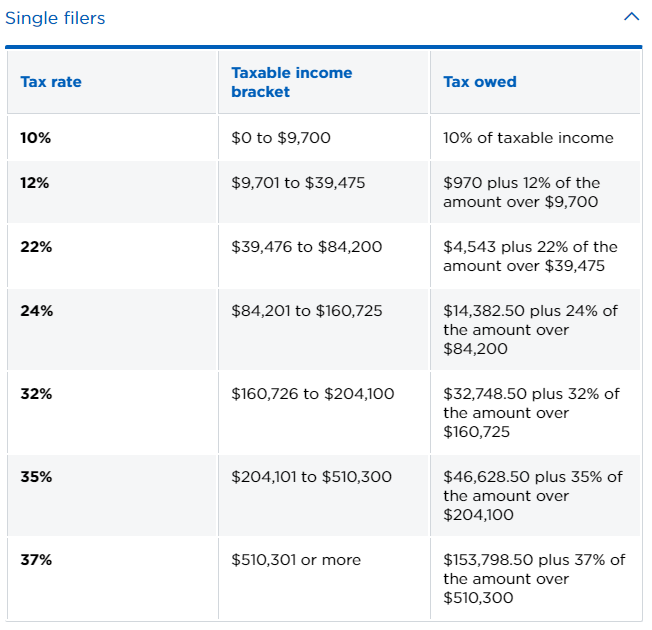

Federal tax rates are as follows:

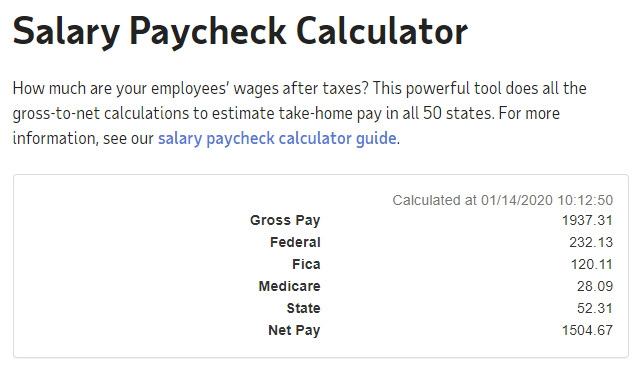

You can get a pretty good estimate for what your net income will be using the Paycheck Calculator. Simply add your yearly gross pay in the gross pay box, leave everything else as is, go to the bottom and hit calculate. You will get a display that looks like this:

Open “Post College Finances” in Google Classroom and follow the directions. You are going to use your gross yearly salary to calculate your monthly net income. This is the amount you will be using for your future budget.

College Debt (My Future Budget)

You may have generous parents who will pay for your entire college career. You may get a full ride with some sort of scholarship. For your My Future Project, we are going to assume that you will leave college with some debt. If you are average, you will graduate with a college loan of $31,172 with an average monthly payment of $393 (this will be different if you have a professional degree). Your college debt is going to be $31,172 or 75% of your starting salary, whichever is lower.

You need to calculate a payment plan to begin paying down that debt. You can choose a lower monthly payment and have more money right now, or you can pay it off quicker and pay less interest in the long run.

Use this student loan calculator to figure out how much you want to pay each month. Your interest rate is 6%. Your minimum payment is $175. You maximum payment is whatever you can afford. In your My Future doc, write a sentence like the one below describing your debt and repayment plan. Write up how much college debt you have, and what your payment plan is. Write it up like this and include it under “College Debt” on your My Future Project. Again, replace the blue text with your own numbers, and change all text to black.

My college debt is $29,400. According to the loan calculator, if I pay $350 per month on my student loan, I will pay it off in 9 years, 5 months with a total of $9,926 paid in interest.

Job Application & Housing

Job Applications for Teenagers

Tips for Submitting Online Job Application

Imagine you’ve just graduated from college and you can begin your adult life where ever you want. Where would that be? Write a list of 5 things you want in your future hometown. Do some city searches and decide on your top 3 choices.

Next, search for a job in a town of your choosing. Imagine you apply for and get that job. You are going to need to do some investigating to find the actual location of your employer.

Next, figure out how much you want to spend on housing. A good rule of thumb is to allocate 20% (very conservative) to 35% of your net income to housing.

In the My Future Project, we will assume that you are beginning your career and choose to rent a place to live. You can choose a house, condo or apartment. You need to find a place to somewhere near where you are going to work. Once you find a place, type the name and address in your My Future Project, and insert a hyperlink to the rental listing. Next, go to Google Maps to calculate how far you have to drive to get to work. Use the snipping tool to capture the addresses and a picture of the map. Insert these into your My Future Project.

Transportation (My Future Budget – Sheet2, cell E8)

Time to find your first car. You will be taking a loan out, so you will need to be reasonable about the kind of car you buy. To find a car, search AutoTrader.com. You could also check “used car dealership” followed by the city or state you plan to live in.

Once you find a car you like, use the Bankrate Auto Calculator to figure out your loan payment amount.

http://www.moneycrashers.com/buy-new-used-car-lease/

Add the following transportation information to your Google Doc if you plan to buy a car:

- Year, Make and Model of Car

- Cost

- Monthly Payment Amount

- a picture of the car, and a link to website you found it on

It should look like this in your My Future Document:

Car Year, Make and Model 2000 Honda Civic EX 2-door

Cost $6,000

I borrowed $6,000 for 3 years and 10% interest.

Monthly payment $194

Some people may choose public transportation. If you want to use public transportation, you have to 1)confirm that it exists in the are you live in, 2)confirm that there is a route close to your home and work, and 3)add a link to your Google Doc for the page with fare prices.

Add the following transportation information to your Google Doc if you plan to use public transportation:

- a link to show that public transportation in you city includes a route that will get you from home to work

- a link to the cost page

Savings (My Future Budget – Sheet2, cell E9)

There are some people who suggest saving 10% of your income and giving 10% away to a good cause. Some call the latter a tithe. Other’s call it a charitable donation. If you want to give away part of your income to a church or other cause that’s fine, but first, pay your future self. Look at what you have left from your net income, and calculate 10% of that amount. Divide the number by 12. Add a line on your Google Doc:

- Savings per Month(and write the amount)

If you want to save more, or donate somewhere, indicate so on your Doc.

Activity 3 – My Future Budget

Generic Monthly Cash Flow Plan

Open up the Spreadsheets Document on Google Classroom.

Add your yearly income to cell E2.

Change cell B12 to the name of the state you will live in.

Change cell D12 to the state income tax rate for the state you choose to live in. Click on the State Income Tax link in cell C12 and then click on your state to find the state tax rate. Remember the percent symbol.

Click on the FICA link in cell A16. Use the Social Security and Medicare Contributions calculator to find your FICA contribution. Type your yearly gross salary in the salary box. Click “Calculate”. Your FICA amount is listed beside “Employee’s Half”. Add that amount to cell E16. Notice your yearly and monthly net pay is calculated on line 20. This is the amount of money your have to spend on living.

Click on sheet 2 at the bottom of the spreadsheet.

About delayed gratification and financial success