We’re going to start off with a little creative writing in which you imagine yourself 10 in the future.

Imagine you are 25 and moving along in a nice life, setting the foundation for a successful adulthood. There are many, many curveballs that life will throw you as an adult, unexpected events that impact your time, finances and emotions in challenging ways. Some of you may have experienced these kinds of things already.

But this is a best case scenario story, things are rolling along and you’ve had it quite easy. You’ve been able to acquire the skills or education that enable you to move into a career that you feel suits you. You may have some debt, but you are thinking about your financial goals for the next little while. Maybe that involves buying a house, saving for retirement or getting a car.

By the end of this unit, you should have a pretty solid idea for where you could be financially at age 25. You will have an idea for what kind of life your job buys for you. Hopefully, you will also understand some best financial practices to do as a young person, and some financial pitfalls to avoid.

Let’s start by landing on a good first job and thinking about your day to day life.

What Does 25 Look Like?

Create a Google document called “My Day to Day at Age 25”. Copy and paste the following questions into it. Answer the questions while trying to imagine what your life will be like in 10-15 years.

How do you make money?

Where do you live?

Did you go to college?

Do you make a lot of money?

Do you pay rent where you live, or have your bought a house or condo?

What do you do in your free time?

Who are the people in your circles?

How do you feed yourself?

Do you have to do chores?

What are they?

Does your work spill over into your personal life?

Do you think you will love your job? Why or why not?

Do you commute far?

How much time does your work take up?

Do you have insurance? What kinds?

Are you in debt? From what?

Optional – with your prospective future in mind, write a letter to your future self at futureme.org. Think of it as a pep talk, reminding yourself what your ambitions were as a younger person. You can pick your school email if you want it to be sent in 4 years or less. Otherwise, you’ll have to use a personal email.

College – Necessary or Not?

Each of you will choose a career path as young adults. It’s something to start thinking about now. A big decision you will make is whether or not to go to college.

There has been a lot of public debate on this question.

Your next job is to read about, understand and communicate the arguments for or against the necessity of a college education. Go to Google Classroom and complete the assignment called “College – Necessary or Not?” Be prepared to explain and defend your position.

College Financing

EverFi’s Pathways: Financing Higher Education helps prepare students to make wise financial decisions when considering how to best finance college.

Students learn about topics like financial aid, applying for FAFSA, student loans, and budgeting for responsible loan repayment.

Log into EverFi’s Pathways: Financing Higher Education and complete the module. It should take about 30 minutes. Your goal is to get 70% or better on the quiz at the end.

If you didn’t get 70%, review and learn the terms or take this practice quiz. Once you’re confident that you know them, log back into EverFi and try again.

College Pathway & Debt

Use the Time for Payback simulation to practice making decisions about your path through college and how much debt you may end up with. Once you. Complete the “Cost of College” assignment in Google Classroom as you work through the simulation.

Career Information Table

Choose a career to research from the Occupational Outlook Handbook. This is the career you will use for the remainder of this project. Create a document called “Employment Profile”. Insert a 2×6 table. Write up an employment profile like the one in the table below.

You will just use Google for “Level of Education Required – School”. Once you choose a school, you have to confirm that the school has the program you are interested in. Not all colleges offer all degrees. Search the name of the school, and the program you hope to enter.

Write what degree you are going to get, and then link to the degree page from the college you found.

For Reference

| Degree Level | Completion Time |

| Associate degree | 2 years Most often offered at a community college, aims to give students the basic technical and academic knowledge and transferable skills they need to go on to employment or further study in their chosen field. |

| Bachelor degree | 4 years A bachelor’s degree encompasses 120 semester credits or around 40 college courses, and typically only 30 to 36 credits—10 to 12 courses—will be in your major area of study. The rest will be in liberal arts. In most cases, more than half of a bachelor’s degree consists of general education or liberal arts courses in areas such as English, critical thinking, psychology, history and mathematics. The bachelor’s degree remains the standard for entry into many professional careers. |

| Masters degree | 1-2 years A master’s degree is typically 30-40 semester credits or around 10 classes of advanced study within a specific field. People often get a master’s degree to increase their expertise in their chosen field, to advance in their organization, and to get better pay. |

| Doctor of Philosophy degree (Ph. D.) | 3-4 years Doctoral degrees are the highest possible degrees available in their field. Doctorates can be both applied or research-based degrees and they usually attract learners who already hold master’s degrees. A doctor of philosophy degree, or Ph.D. is typically 60 semester credits or around 20 classes of advanced study within a specific field. A doctor of philosophy degree, or Ph.D., emphasizes research. Earning a doctoral degree can be a pathway to career advancement, increased salary potential, and leadership credentials. |

Basic career information table.

| Job Title | Civil Engineer (Link to the Employment Outlook Handbook page) |

| Level of Education Required – School | Bachelor Degree – Virginia Tech (Search for a College with the applicable degree and link to it) |

| Total Cost of College | Virginia Tech estimated cost $109,132 – College Calc – Virginia Tech (Search the cost of the degree at the school you choose and link to it) |

| Starting Salary | $50,370 (Check the “Pay” tab on the Employment Outlook Handbook page, find what the lowest 10% earned. That’s your salary) |

| Employment Outlook | Employment of civil engineers is expected to grow 19 percent from 2010 to 2020, about as fast as the average for all occupations. (Copy and paste the first paragraph on the “Outlook” tab from your Employment Outlook Handbook page) |

| What They Do | Civil engineers design and supervise large construction projects, including roads, buildings, airports, tunnels, dams, bridges, and systems for water supply and sewage treatment. (Copy and paste the first paragraph on the “What they do” tab from your Employment Outlook Handbook page) |

There are some jobs that provide substantially more income than a typical bachelors degree. Pursuing these degrees in real life requires and extra measure of effort. The same will be true in your “Employment Profile”.

Becoming a professional with an advanced degree takes an extra level of commitment. If you want a career as a physician, lawyer, dentist, orthodontist, or any other “professional” degree, you need to fulfill the following extra requirements by February 22:

- provide proof of all A’s or almost all A’s in middle school so far

- be involved in at least one extracurricular activity

- provide a detailed formal business letter explaining (example)

- why you think your chosen profession is a good fit

- you’re parents thoughts on your chosen profession

- and how you plan finance your extended education and your anticipated post graduation debt amount

- provide a letter of recommendation – from a non-family member, or a teacher (not Mr. Brumwell). The letters should complete the statement, “why I think (insert your name) would make a good (pick physician or lawyer)”. The letters should include information about your academic performance, ability to manage extracurricular activities and your character in general.

Now we’re going to deal with your post college income. We are going to look at your taxes first, then we will create a budget. You will complete this section on a Google Sheet called “First Budget”.

Two key concepts when dealing with taxes are:

Gross Income – the entire amount of money you make.

Net Income –what you have left after you pay your obligatory taxes.

Once you’ve found your dream job, there’s an important detail to consider when you look at the amount of money you earn and begin to plan how to spend it. One of the disappointments of that first paycheck is learning that all the money you make is not yours to spend. You live in a country, state and city that each provide services to you as a citizen.

These services are paid with tax dollars. The tax dollars come from you as a wage earning citizen. You will pay income taxes to the federal government, state government and whatever type of municipality you live in (township, city, village, etc.) You will also be required to pay into medicare, social security and possibly have additional money deducted from your pay for retirement savings or healthcare.

The amount you get paid is called your gross income.

The amount you have left after taxes and deductions is your net income.

A typical, middle income family in Grand Blanc will likely pay around 1/3 of their gross income in various taxes. Net income is the money you get to spend. If your salary/gross income is $100,000, you get to keep about $66,666. That’s called your net or take home pay.

For this project, you will calculate your federal income tax, state tax, social security and medicare. Each of these taxes helps pay for a benefit that you have as a U.S. citizen. You can read this article at National Priorities from 2015 to get a more clear picture of what the U.S. Federal Government spends its money on.

Below are the 2021 Federal tax rates for filing as a single person:

2021 Federal Tax Rates

- 10% on taxable income from $0 to $9,950, plus

- 12% on taxable income over $9,951 to $40,525, plus

- 22% on taxable income over $40,526 to $86,375, plus

- 24% on taxable income over $86,376 to $164,925 plus

- 32% on taxable income over $164,926 to $209,425, plus

- 35% on taxable income over $209,426 to $523,600, plus

- 37% on taxable income over $523,601 or more

Time to calculate your:

- Federal Income Tax

- State Income Tax (if applicable) and

- FICA payments.

Open the Google Sheet called “First Budget – Taxes” posted in Google Classroom. Find cell E2. It has a blue background. Replace the number in that cell with the starting salary you listed on your employment profile last week. That’s the bottom 10% amount for your starting yearly salary that you found in the Employment Outlook Handbook. Your total, yearly, graduated federal income tax will appear in cell E13.

State Taxes

The next portion of your income tax withholding is your state individual income tax. This varies from state to state. Some states actually don’t withhold individual income tax. Maybe you got lucky and landed in a state with no income tax.

There are some nuances in state income taxes, but for our purposes, your state income tax can be found here – U.S. State Income Taxes.

Find the state income tax for the state you hope to land in and enter that amount as a percentage in cell D15. Be sure to include the percent symbol. Your state tax will automatically be added to cell E15.

States still need money to operate and they will get it somehow. Heres a list of the various ways states fund their state operations.

Property tax – money taxpayers (businesses and individuals) pay based on the value of property they own. If you own a house or other property, you will pay property taxes. Rates vary based on the state and the type of property.

Sales tax – this is a tax paid on consumer goods like cars, groceries and phones. Items that you need to pay sales tax on vary from state to state, for example, some states don’t tax groceries. The percent of the purchase you pay tax on also varies from state to state. Louisiana has the highet combines sales tax at about 10%. Michigan’s current sales tax is 6%.

Corporate income tax – this is a tax businesses pay based on the amount of money they make.

other taxes – states may levy other taxes and fees to add to the state budget. These include fees and taxes on vehicles, gasoline, and hunting and fishing.

Notice your Federal Insurance Contributions Act (FICA) has also been calculated. This is a mandatory withholding. It is paid collectively by you and your employer. The Social Security portion is 12.4% of your gross income. The Medicare portion is 2.9% of your income. Thankfully, both of these are shared with your employer, you each pay half. The amount shown in cell E19 is 6.2 % + 1.45% of your income.

If you’ve done everything correctly, you should see your gross income, total deductions and net pay in cells E21, E22 and E23. Yay! Now you know how much you have to spend to create a life for yourself, your net income per month in cell F23.

Read about and calculate your effective federal tax rate

State Tax Rates

State Tax Revenue Graph

State Tax Revenue Table

What is FICA (the Federal Insurance Contributions Act)

What is Social Security?

What is Medicare?

Social Security & Medicare calculator

Next, on a doc called “Post College Financial Reality” you are going to complete a statement about your income and your college debt.

Post College Financial Reality

Start by completing the “Post College Financial Reality” doc in Google Classroom. Replace the existing blue text under Gross v. Net Income with the correct information from your “First Budget – Taxes” spreadsheet. Change all text to black when done.

College Debt Calculations and Payment

Next, calculate your college debt payment and complete the College Debt section by replacing the blue text with your information and then changing the text to black.

You may have generous parents who will pay for your entire college career. You may get a full ride with some sort of scholarship. If you start planning now, you may be able to borrow little or no money at all to pay for college.

However, if you are average, you will graduate with a college loan of $29,800 (this will be different if you have a professional degree). This is the amount of college debt you will use for your budget.

You need to calculate a payment plan to begin paying down that debt. You can choose a lower monthly payment and have more money right now, or you can pay it off quicker and pay less interest in the long run.

Use this calculator to figure out how much you want to pay each month. Your interest rate is 6.0%. Your minimum payment is $150. Your maximum payment is whatever you can afford. Complete the statement regarding college debt on the “Post College Financial Reality” doc.

Home Options

Next, you’re going to use a Google Doc and a Google Sheet, each called “Home Options”, to research and compare mortgages, down payment options and rent.

Buying a home is a pretty big deal. Before you buy a home, you should consider the following questions

- How much can you afford as a monthly payment?

- How much savings do you have?

- How long do you plan to stay in the home?

- Do you want stability or flexibility to move around?

- Do you want to be responsible for repairs/maintenance?

- What are your financial, career and family goals?

Renting v. Buying a Home

Millennial Home Buying Misconceptions

Minimum Mortgage Requirements

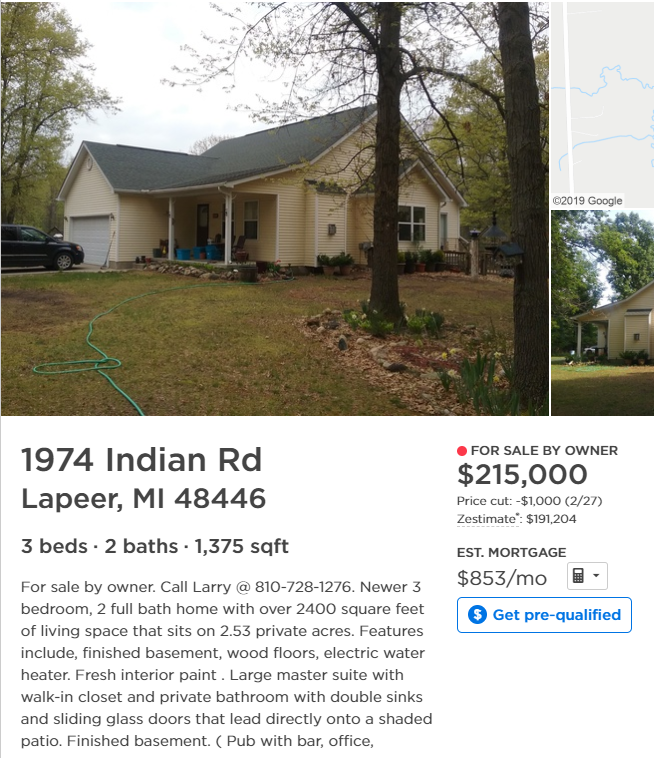

Find a house on Zillow, close to your job, that costs about 3 times your gross salary. Add a screenshot of the basic list information like this one.

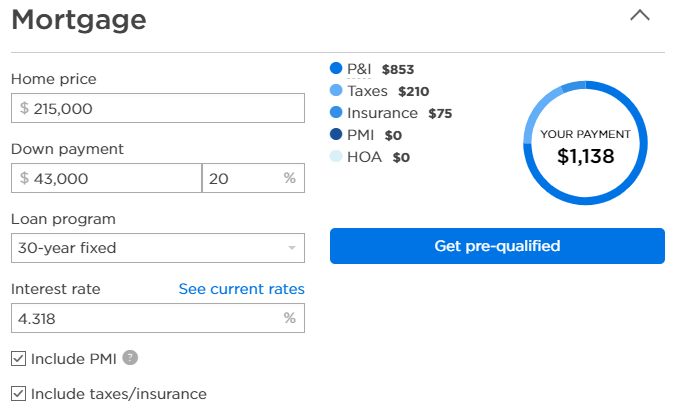

Next, use the Mortgage section on the Zillow listing to help do some calculations so you can compare some options for your mortgage. Open the Home Options Spreadsheet. Use the Zillow mortgage calculator to find the monthly payment based on the 4 scenarios.

Next, use the Google Mortgage Calculator to find the total cost of the loan. Add this information to the spreadsheet.

The total cost of the mortgage is your out-of-pocket cost to buy the house. As you can see it varies greatly. These numbers can have a dramatic impact when you think about your life-time earning capacity. By taking what appears to be the easier route now (lower down payment, longer time to repay the loan) it costs you more out of pocket. That extra amount could be a big nest egg, a vacation cottage, or a big chunk of a college education for your children.

Assume you’d like to own a home. You get to decide how much you want to spend, how much of a down payment you want to save for, and how long you want the mortgage to go for. Complete the statement below with numbers and information that make sense to you.

I plan to buy a home X years after I graduate from college. I’d like to spend around $X. I’d like to save for a X% down payment which would be $X. There are X months in X years. I will need to save $X per month to reach my goal of $X in X years.

Your finished version should look something like this:

I plan to buy a home 5 years after I graduate from college. I’d like to spend around $1,400,000. I’d like to save for a 10% down payment which would be $140,000. There are 60 months in 5 years. I will need to save $2333.33 per month to reach my goal of $140,000 in 5 years.

Current Living Situation

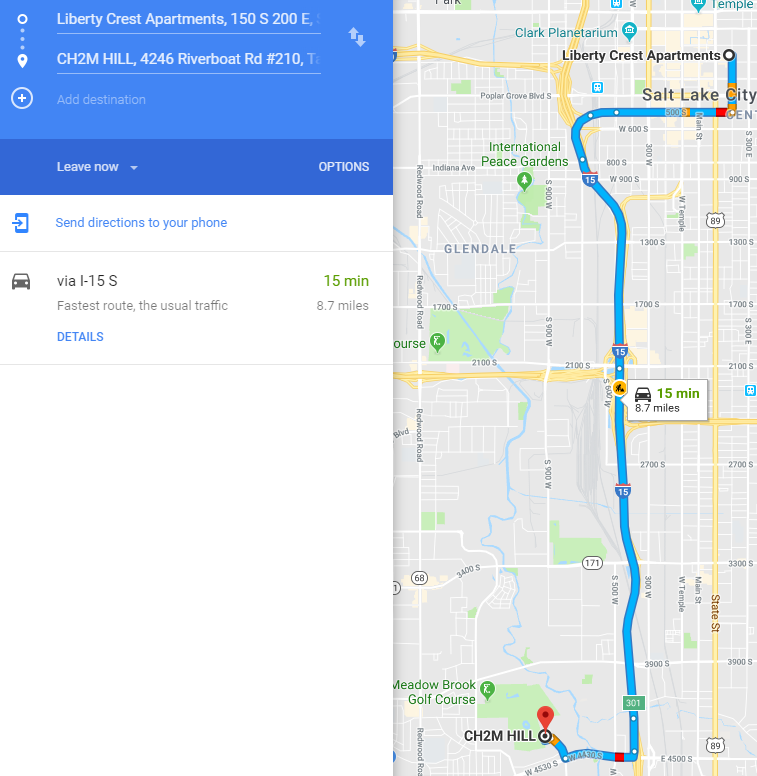

Add information about your current living situation to the Home Options doc. Tell the name, style and cost of where you live. Finally, use Google Maps to take a screen shot of your commute. Be sure to include the mileage details from the left sidebar. It should look like this:

I am going to rent a one bedroom “Bay” model apartment from Liberty Crest Apartments at 150 S 200 E, Salt Lake City, UT 84111 for $1,215. My commute is .2 miles.